Handling student loan debt isn’t the easiest thing to take care of. Just about every student in university struggles with student loan debt. Fortunately, there are a plethora of ways to navigate this.

Table of Contents

Opting for Student Loan Deferment

If you go for a student loan deferment, you will essentially be delaying your loan repayments. During the deferment period, the interest on your subsidized loans will not accrue. A student loan deferment offers you the option to temporarily pause your repayments or reduce the loan amount you are repaying for up to three years. You can opt for a student loan deferment if you are facing financial hardship, studying in a university, serving in the army, or do not have adequate income levels.

You need to know the following before you decide to go for a loan deferment:

- Student loan deferment works very well for subsidized loans since the interest on the same will not accrue during deferment. However, if you have unsubsidized loans, this may not be the best option.

- A student loan deferment can work if you have a temporary financial setback that you can bounce back from. However, not having a plan to make repayments on the loan in the foreseeable future will make things difficult for you if you are considering loan deferment.

- Instead, look for ways to make reduced loan repayments if possible. If this is possible, an Income-Based-Repayment (IBR) plan might suit you better.

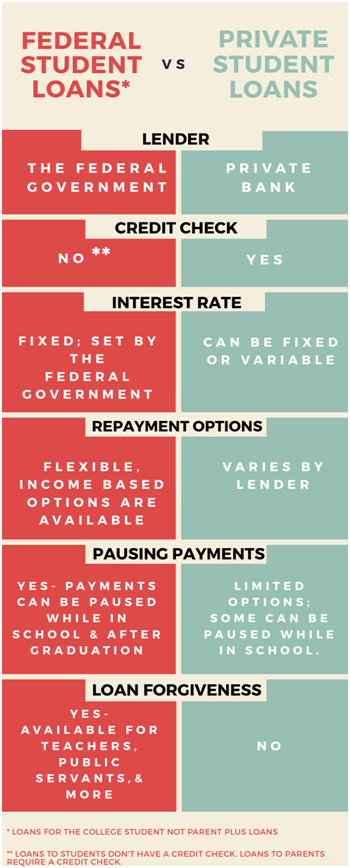

Private and Federal Loan Deferments

Here’s how private loan and federal loan deferments are different from each other:

- For a private student loan deferment, make sure you reach out to vendors and find out the deferment terms since the deferment terms vary with each lender. Choose the lender that favors you the best. You could potentially get a student loan deferment if you can enroll yourself in a university. However, this depends on the lender in question.

- In this case of a federal loan deferment, you will have to apply. If you can enroll yourself in a university at least half-time, you could avail an in-school deferment. Be sure to check with the U.S Department of Education, select the deferment option, and choose one that you qualify for and suits you the best.

Opting for Forbearance

Forbearance is another option for you to keep in mind. In the case of forbearance, you can expect the lender to decide if they wish to approve your request for forbearance. If your request is approved, you will be given temporary relief from continuous repayments on your loan. Be sure to note that the interest on your loan will accrue while in forbearance.

Another thing to keep in mind is the fact that the lenders you approach will expect you to explain why you are not able to make repayments on your loan. You can get your request for forbearance approved in the following situations:

- If you are no longer working

- If you are facing financial hardships

- If you need your monthly repayment money to finance your medical expenses

You can qualify for student loan forbearance if you have a Perkins loan, Direct loan, or a loan you may have applied for through the Federal Family Education (FFEL) program from American education services.

Opting for Student Loan Forgiveness Programs

Student loan forgiveness is an excellent option you ought to consider. However, you should keep in mind that this is not available to everyone. There are a variety of student loan forgiveness programs for you to choose from. Check if you are eligible and select the one that best suits your needs.

The following situations will tell you how you can be eligible for student loan forgiveness programs.

- Your chances of getting a student loan forgiveness program go up if you are a teacher because there is a program for teachers. You may get up to $17,500 forgiven from your loan amount, provided you complete five consecutive years as a teacher in a school that pays you a low salary.

- Also, serving in the military can do well to boost your chances of getting a student loan forgiveness program since there is a repayment scheme for every branch of the military. You can get different chunks of your loan amount forgiven, entirely depending on the rank you hold.

What you should know about the Public Service Loan Forgiveness Program

In a nutshell, the Public Service Loan Forgiveness (PSLF) program is one of the most commonly used student loan forgiveness programs. It is specifically designed to help those who work in the public sector, holding jobs in the nursing, military, administration, teaching, and other fields. Do note that you will have to make repayments on your loan for ten years before you can expect to have your loan forgiven. If you want to find out how much of your loan amount you can have forgiven, make sure you use a PSLF calculator.

There you have it – simple, viable options to consider as a student who is struggling with student loan debt.