How to resolve Quickbooks Error code 392

QuickBooks is certainly a critical application common place to any individual who works with the money related parts of bookkeeping. It is helpful programming actualized for computing finance and checking through various exchanges of any organization.

Quickbooks Desktop Support to help customer for any help in Quickbooks our technician solve their problem in a minute. We can available to take call 24/7. Regardless of whether you are opening an independent venture or taking care of a major one, Quickbooks is basic and required all over. In any case, even great programming like Quickbooks has a few false notions that can’t be maintained a strategic distance from.

Quickbooks Error 392 is a typical mistake that distress the Quickbook program now and again. While it is anything but difficult to abstain from submitting such mistakes. In any case, at that point once it appears on the screen, it is smarter to fix it basically and rapidly to deal with every one of the issues. With the goal that you can return to work.

QuickBooks Error 392 is characteristic of an infection invasion in your working framework and should be managed cautiously to spare your documents and every one of your information. While Quickbooks is a protected program which demonstrates no impact of getting hacked, the infection may make it breakdown and face rehashed terminations.

The product will keep on closing down suddenly with no reason and just presentation a remorseful exchange box. In any case, in this article, we will thoroughly understand the different parts of QB blunder 392 and how to manage it adequately.

Table of Contents

Cause of QuickBooks Error 392

- The accompanying signs will see on your PC if this QuickBooks mistake 392 happens.

- There can be an announcement of QuickBooks error 392 on the reassure screen which appears and crashes the dynamic program window.

- At whatever point a comparable document gotten to by the Quickbooks application, the product will crash and flounder.

- The exchange box will appear and unexpectedly closed down the application.

- Windows turns out to be extremely unpredictable to the upgrades or messages and the comfort or mouse yield is exceptionally moderate.

- The PC won’t work legitimately and stuck in one specific mode for a long measure of time.

What reason caused Quickbooks error code 392

- There has been inappropriate or sporadic downloads or divided record nearness of QuickBooks programming.

- Absence of legitimate authorizations and powerlessness to perceive the Quickbooks computerized signature in the Windows vault from an on-going QuickBooks-related programming change can cause this sort of blunder.

- An infection or suspicious program that has ruined one of the center records required for Quickbooks and along these lines making this mistake happen every now and again.

- At the point when some program or firewall that has superseded the essential Quickbooks authorization.

- Erase Caused the critical and required documents.

- At the point when the program influenced trying to handling by a degenerate record and causes this mistake alongside a run-time error.

How to solve this QuickBooks Error Code 392

- The primary thing keep up and fix the library.

- Sweep every one of the passages related with the QuickBooks Error 392.

- So as to keep any further assaults by malignant programming, lead a full foundational examine on your PC.

- Utilize the official cleaner of the reassure and use it to evacuate any impermanent reserved and degenerate documents present.

- Update both the drives of the reassure with the ongoing adaptation.

- Utilize the hate program catch to convey back the application to its default state.

- Erase the Quickbooks application present and complete an exhaustive check with a firewall to restore it once more.

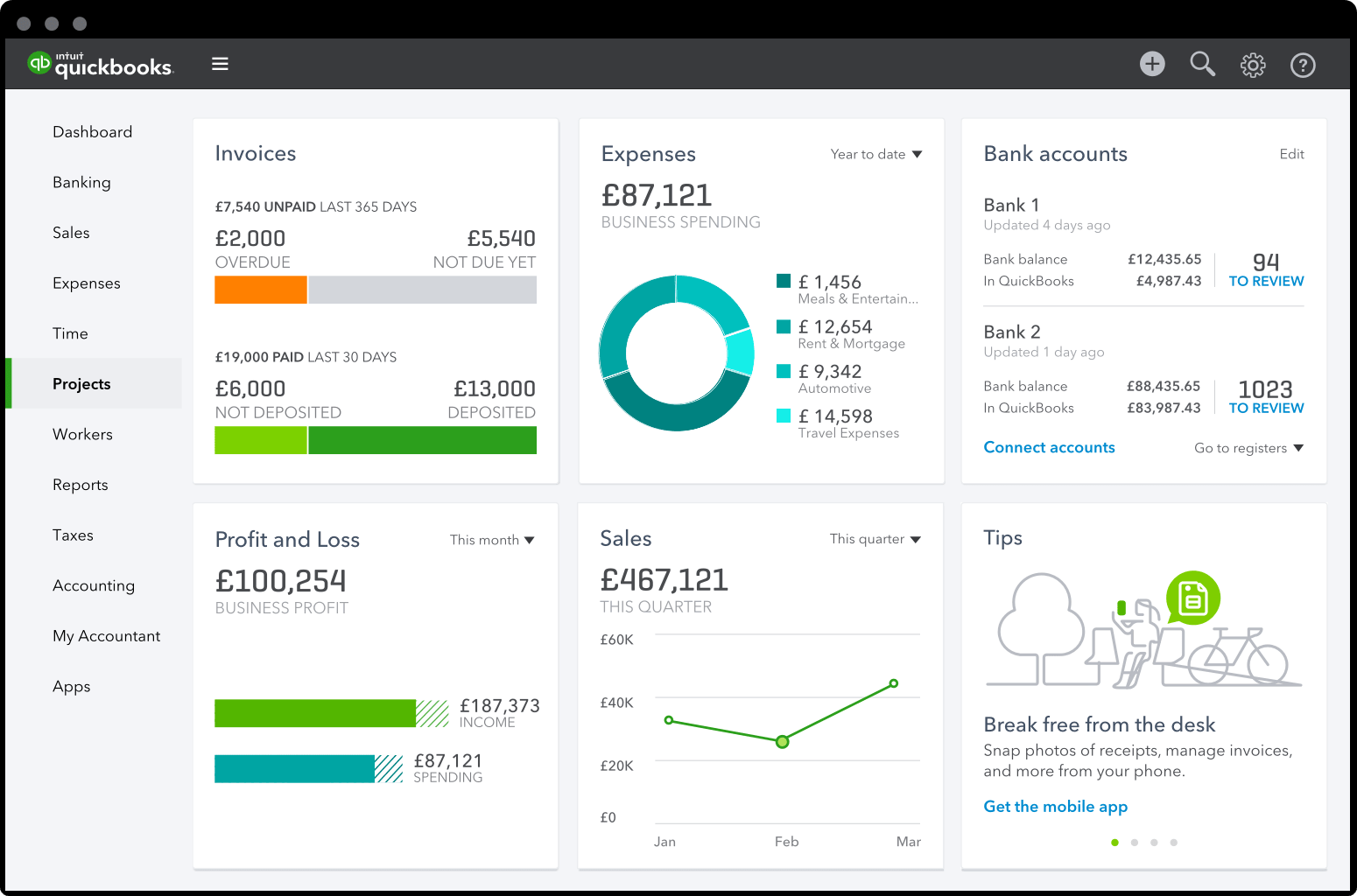

What are Quickbooks and how to use it

QuickBooks Desktop Support finance will depict the finance procedure for a private venture in detail, so clerks, bookkeepers, and entrepreneurs can more readily see how to set up finance, process finance, and investigate issues identified with finance. This course will present the finance set-up in the QuickBooks Desktop framework, strolling through finance screens for both the paid variant and the free manual rendition of finance inside QuickBooks Desktop. We will talk about finance enactment that will influence finance estimations inside QuickBooks Desktop and list the finance shapes we should create from Quickbooks.

The course will stroll through the way toward entering another worker into the QuickBooks Desktop Pro 2019 framework and depict where the information would be gotten from by and by including Form W-4. We will examine Federal Income Tax computations inside QuickBooks support. The course will portray how FIT is determined, what is required for QuickBooks to ascertain FIT, and how to enter the information into the bookkeeping framework. The course will portray the Federal Income Contributions Act and its parts. If need help you can contact us to our Customer services.